|

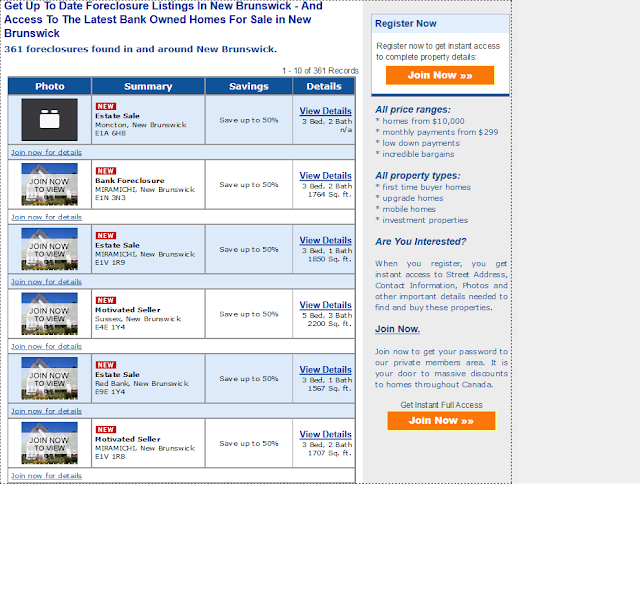

361 Records: Access The Latest Bank-owned Houses for Sale in New BrunswickGet Up-To-Date Foreclosure Listings, New Brunswick; Access The Latest Bank-owned Houses For Sale in New Brunswick |

Purchasing a foreclosure property in New Brunswick is always a bit tricky. Firstly, it's difficult for buyers to evaluate a good deal versus a bad deal as several foreclosed houses offered for sale might not allow professional home inspection. Be aware that a foreclosure house sale is not your regular real estate deal and the seller is the court - not the realtor.

In New Brunswick, as the foreclosure listings are expected to expand, many buyers including flippers, investors, and first-time buyers will bid for these foreclosed properties.

The slipping economy has caused a lull in the traditional real estate market. However, the foreclosed houses, due to their much lower prices, are still in strong demand. Furthermore, many people find purchasing and reselling a foreclosed house with little remodeling a very lucrative opportunity for earning significant profits in a short period of time.

Whatever your motives are for acquiring a foreclosed property in New Brunswick, the following 5 tips will significantly help you in making a good deal:

- Make sure what you bid for. Foreclosed properties are listed for sale either by the court or local banks. Since neither the court, nor such banks have any know-how or business interest in buying and selling real estate, most foreclosed properties in New Brunswick are sold in the as-is condition and do not offer any added feature or abide by any conditions set out by buyers. Thus, when you decide to buy a foreclosed property, make sure that it's worth at least the listed price.

- Make provisions for a down payment. Considering you find the property to be in order and have also won the bidding, you'll need to part with a hefty down payment in a short period of time. To avoid any last-minute desperation owing to lack of liquidity, many smart investors provision for the down payment much before applying for foreclosed homes.

- Do your own research. No research is better than the ground one. Knocking on a few doors may actually reveal much more than the legal documentation may ever include. Neighbors can tell you about the current market value of properties in such area, and they can also provide relevant info. about the foreclosed property itself. You can also learn a lot about the previous owners from locals in the area itself - e.g. whether they ever reported a leaking basement, or how they kept the house.

- Check for Permits and Titles. It's important to examine carefully whatever liens, permits, and titles, are available for such foreclosed property. For example, there might be a possibility that the court may not provide you with any permit for the garage or the deck. Similarly, careful examination of titles will help you ascertain if such property has any unpaid dues in bills, debts, or taxes. Whether an investor, flipper, or home buyer, everyone must be ready to expect anything in a foreclosure property transaction. It's safer to make pre-calculations considering the worst case scenario, before bidding for the foreclosed real estate listing.

- Benefit from an online listing service. Access to validated information plays a key role in buying a bank foreclosed property. This is where online mls listing services come to your rescue. The online and app based listing services regularly features foreclosure homes across Canada (CLICK HERE). Furthermore, you'll also receive posts containing real estate industry research reports and other knowledge resources for keeping buyers in-step with the Canadian foreclosure marketplace.